Mondi is one of the biggest players on the kraft paper and paper bag markets in Europe and globally. The company plans to strengthen its position with a new kraft paper machine at the Štětí mill in the Czech Republic.

Mondi said it was mulling over a new investment at the Štětí mill in Czech Republic in order to meet growing demand for paper-based flexible packaging. “We are well advanced in the evaluation of an investment in a new 200,000 t kraft paper machine at Štětí [and] expect to be in a position to make a final decision on the investment in the second half of 2022,” the company announced. The group puts the total Capex for the capacity expansion in Štětí at €350m.

In 2021, Mondi ramped up its specialty kraft paper machine at Štětí mill. The paper machine was converted from corrugated case material production to kraft paper and features a production capacity of up to 130,000 tpy. The paper is made combining primary and secondary fibres and is used for the production of shopping bags, Mondi explained.

Štětí mill is an integrated pulp and paper mill site and counts among the largest paper mills in Europe. Štětí houses six paper machines with a combined capacity of more than 1 million t of woodfree uncoated paper, corrugated case material, and kraft and sack kraft paper. The mill also produces some 600,000 tpy of bleached and unbleached pulp.

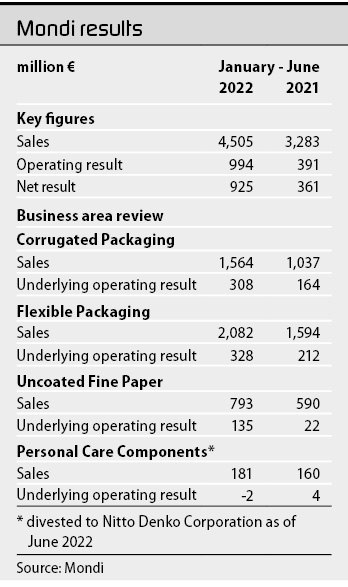

Mondi posts strong H1 2022 result

Following Russia’s aggression on Ukraine Mondi assessed the options for the group’s interests in Russia and, as announced in early May, decided to divest the group’s Russian assets, including the integrated pulp, packaging paper and uncoated woodfree paper mill in Syktyvkar and three corrugated packaging plants in the country. All those facilities primarily served the domestic market and have continued to operate through the six months ended 30 June, but have been classified as discontinued operations held-for-sale in the first half-year 2022 accounts, Mondi explained.

Looking at the group’s continued operations, Mondi reported a strong business with good margins in all business divisions for the first six months of 2022. The group said it has positioned itself well and thanks to its vertical integration, the group’s agility and strong collaboration with customers remained able to deliver despite the global supply chain disruptions. At the same time, the company has kept costs under control against the backdrop of rising inflation and increased its own selling prices.

Mondi also competed the disposal of the Personal Care Components (PCC) business to Japan’s Nitto Denko Corporation at the end of June 2022 for an enterprise value of €615m. As a result of the sale, Mondi recognised a pre-tax gain on disposal of €246m.

The Corrugated Packaging division delivered a strong performance, according to Mondi, with 51 per cent higher sales and an 88 per cent increase in underlying operating profit compared to the same period in 2021. The business saw overall weaker corrugated demand in the markets in Central Europe and Turkey which impacted volumes in these regions. In general, containerboard and corrugated box shipments were up on the comparable period 2021.

Mondi benefited from higher prices and additional capacity through new plants and acquisitions. In addition, the company was able to implement higher sales prices for corrugated case materials and transfer these higher input paper costs to box prices accordingly. This mitigated the impact of higher expenses for wood, recovered paper, chemicals, energy and transport.

In the Flexible Packaging division, Mondi was also able to offset the cost increase and achieve a better result than in the first half of 2021 thanks to higher shipments at higher selling prices, and “successful cost control”. Segment sales rose 31 per cent and the underlying operating profit was up 55 per cent year-on-year. Mondi saw volume growth in retail applications, in particular paper-based shopping bags and e-commerce shipping bags, and consumer applications, such as food and pet food. Demand from the building materials and construction industries also developed positively in the first half of the year.

The Uncoated Fine Paper division reported a 34 per cent increase in sales and the underlying operating profit was six times higher than in the first half of 2021 at €135m. Mondi said it benefited from significantly higher selling prices for paper and pulp, good operational performance and focused cost control. The company reportedly expanded its position and grew its share in the European market. The woodfree uncoated paper market in Europe remained tight due to solid demand and recent capacity reduction. Against this background, and with more capacity leaving the market, the customers valued Mondi as a supplier of choice, Mondi stated.

Mondi boasts of the success of previous investment projects in generating returns, including the new kraft-top white containerboard machine at the Ružomberok mill in Slovakia and the specialty kraft paper machine in Štětí. In the first half-year 2022, Mondi invested a total of €218m in its projects and has further projects worth more than €1 billion in the pipeline, the group said.