The acquistion of De Jong Packaging group will accelerate Stora Enso's sales growth and strengthen the company's presence in corrugated packaging.

Stora Enso has announced the acquisition of De Jong Packaging group, the largest independent corrugated company in the Benelux. According to Stora Enso, the acquisition of De Jong Packaging was in line with the company's strategy to accelerate sales growth and increase its market share in "renewable and circular packaging solutions".

Stora Enso puts the enterprise value of the transaction at approximately €1.02bn of which €250m was IFRS lease liabilities. The acquisition of De Jong Packaging has been already approved by Stora Enso's Board of Directors, the company said. But, the transaction is still subject to works council consultation and regulatory approval. It is expected to close in early 2023.

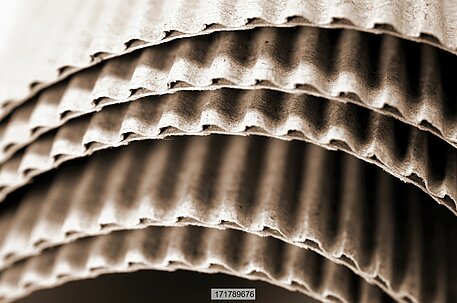

De Jong Packaging Group is one of the major corrugated packaging producers and suppliers in the Benelux countries. The company has 17 sites in the Netherlands, Belgium, Germany and the UK, and specialises in the production of corrugated trays and boxes mainly for fresh produce, e-commerce and industry. Including ongoing expansion projects which are expected to be finalised by 2025 De Jong Packaging Group is said to have a production capacity of more than 1.2 billion m² of corrugated packaging. The group has also been active in recycled containerboard production since the acquisition of the De Hoop paper mill in the Netherlands in 2021. The former DS Smith paper mill houses two paper machines with a total production capacity of 360,000 tpy of recycled fluting and testliner.

In 2021, De Jong Packaging had net sales of €683m and posted an Ebitda profit of €75m. According to Stora Enso, De Jong Packaging’s full year 2022 sales are estimated at approximately €1bn.

Stora Enso Packaging Solutions operates 12 corrugated facilities in Sweden, Finland, Poland and the Baltic States with a total production capacity of almost 1 billion m². The takeover of De Jong Packaging would significantly increase corrugated packaging capacity of Stora Enso's Packaging Solutions division, strengthening the company's presence in the corrugated packaging market in Europe and providing entry into the markets in the Netherlands, Belgium, Germany and the UK, Stora Enso explained. The combination of the two businesses would also secure a platform for continued growth in the fragmented European corrugated packaging markets, it is said.

Stora Enso's containerboard production capacity slightly exceeds 1.9 million tpy. The company runs one recycled containerboard mill in Poland, and one semichemical fluting mill and two kraftliner mills in Finland. Stora Enso also studies a conversion of the Langebrugge publication paper mill in Belgium to recycled containerboard production at a total cost of €400m. The feasibility study is expected to be finalised in the first half of 2023. Stora Enso puts the annual capacity of the converted machine at 700,000 tpy of testliner and recycled fluting grades. Depending on an investment decision, the converted paper machine is expected to come online in 2025.