Outlook for 2023 remains fraught with a number of uncertainties including destocking and inflation.

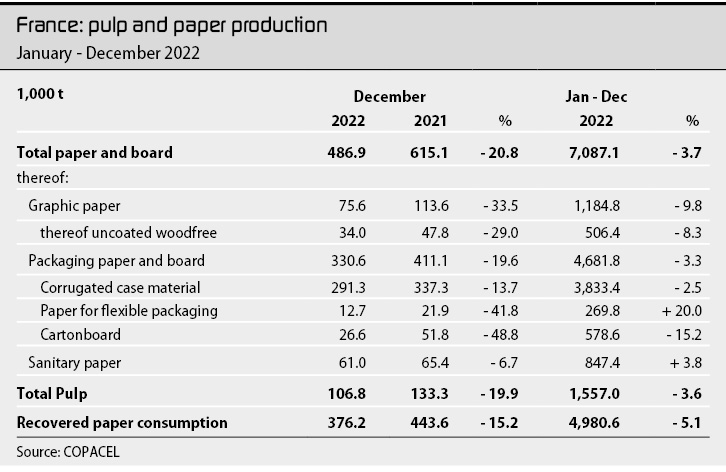

The French paper industry has taken stock of business performance in 2022 with mixed results. Industry association Copacel explained at its annual press conference that member companies were at once confronted with the outbreak of war and three different crises but at least the macroeconomic situation did not play out as badly as feared. Apparent paper consumption remained virtually stable at -0.2 per cent year-on-year. Industry output receded by 3.7 per cent compared with the previous year partly for technical and partly for market-related reasons. A prominent feature last year was the significant increase in production costs – for energy and raw materials – which French companies passed on by way of higher selling prices. The latter was responsible for the industry‘s extraordinary growth in overall sales revenue by 31 per cent year-on-year to €7.7bn.

Although the French paper industry is heavily exporting, the country’s trade balance for the year shows a 24 per cent increase in its deficit to 1.3 million t. The fall in graphic paper output was more pronounced than for packaging paper, not least due to the closure and rebuild of two PMs (Norske Skog Golbey, VPK Alizay), increasing the country’s reliance on imports for printing and writing paper despite the structural decline in consumption. Industry output was also lower due to supply problems for chemicals and wood, technical difficulties, a fire (at Reno de Medici Blendecques) and high energy costs over and above market-related production cuts towards the end of the year.

Although the 3.7 per cent decline of paper output in France last year was modest compared with the European average (-5.9 per cent) or even Germany (-6.5 per cent) or Spain (-4.8 per cent), paper production in the country is on the wane. The closure of several machines for printing and writing paper in conjunction with lower capacity growth for packaging paper has reduced the share of France in total European output to just 8 per cent from 11 per cent ten years earlier.

Contrary to widespread apprehension, inflation that emerged last year did not make a great impact on paper consumption in France, Copacel reports. In the first half of the year, growth in paper consumption was healthy before it faltered in summer, then shrank in the fourth quarter by different amounts depending on the paper grade. The long-term decline of the share of printing and writing paper production in France, like elsewhere, is dramatic: Whereas 44.2 per cent of the paper produced in France in 2002 was for graphic applications, by 2022 this figure had fallen to 16.8 per cent. The share of packaging paper shows the reverse trend, increasing from 45.5 per cent to 66 per cent in the same period.

Production of packaging paper in France performed relatively well in 2022. Now, the industry’s focus for 2023 is on the supply side of the market: emerging containerboard capacities (Norske Skog Golbey und Bruck, VPK Alizay, Schumacher Packaging in Poland and others), are expected to make themselves felt. In addition, roughly another two million tpy of containerboard capacity in North America will reportedly be available in the first nine months of the current year, Copacel adds.

Demand for packaging paper and graphic paper developed very differently in the two halves of the reporting year. For graphic paper, tension grew in the market due to the sizeable withdrawal of capacities as well as the strike at UPM in the first four months of the year. As in the fourth quarter of 2022, the market for printing and writing paper is currently facing low demand due to destocking which is expected to end in April. In general, the publication paper market reflects the receding trend in the number of printed copies of many periodicals. Copacel puts the decline in the total number of printed copies of periodicals in France at 10 per cent in 2022.

Energy costs move to the foreground

For the French paper industry as elsewhere, one of the main topics in 2022 (and to date) is the increase in energy prices. Their increase last year not only pushed up the cost of production but also led to occasional production stops during phases when cost peaks would have caused a loss. The French paper industry consumes around 8 TWh of gas and 6.5 TWh of electricity annually. Energy consumption is very different from mill to mill but the share of externally procured energy in production costs varies from 10 to 30 per cent, according to Copacel. French companies are protected by the country’s ARENH mechanism against spikes in electricity prices. The mechanism regulates access to nuclear power, which accounts for around 75 per cent of the energy produced in the country, by permitting utilities and companies to procure a certain share of nuclear power from monopoly producer EDF at a cheaper tariff of €42/MWh. Furthermore, the French government raised the total quota of cheaper electricity last year on a one-time basis from 100 to 120 TWh, which allowed companies in the country to increase the share of subsidised electricity to more than 75 per cent.

62 per cent of the steam needed by the French paper industry was generated from biomass, Copacel reports. However, the figure varies widely depending on the reliance on natural gas.

The outlook on the energy market for the first quarter of 2023 is fraught with uncertainties for the French paper industry despite recent easing trends. Europe now buys more LNG, which is more expensive than piped Russian gas. Moreover, the merit order principle that is applied to set the price of electricity puts European production sites at a competitive disadvantage compared with other parts of the world, the association writes.

Outlook for 2023 fraught with uncertainties

For the ongoing year, the association also sees positive signals in the markets of its member countries. The switch from plastics to paper in the packaging market is there to stay, Copacel notes. The association welcomes the fact that the public sees the real environmental footprint of digital communication and adopts a more differentiated view of its encironmental impact. Copacel writes that it cannot obtain a clear picture of the true impact of destocking and inflation on paper markets at present.

The association urges politicians to take cognisance of their role in upholding and improving the competitive standing of the French paper industry. For Copacel, this includes lowering the tax burden for industrial production and reforming the energy market to improve the consumers’ availability to the French power mix. The association further demands that the government must put an end to competition for biomass as a source for renewable power and as a raw material. Copacel also sees the need to promote greater recycling of recovered paper on a regional level.